UAE E-Invoicing Is Coming: Most ERP Users Think They’re Ready. They’re Not.

Many finance teams in the UAE believe one thing right now:

“We already use an ERP. We should be fine.”

That assumption is going to create serious problems. Because when e-invoicing becomes mandatory, the issue will not be creating invoices. It will be compliance, format, validation, and government reporting. And most ERP systems do not handle that on their own.

This is where confusion, delays, and rejected invoices will start. Let’s break it down in a simple way.

E-Billing vs E-Invoicing: Why This Difference Matters

People often use both terms as if they mean the same thing. They do not.

E-billing is a broad concept. It simply means you send bills digitally. It gives flexibility but does not follow a strict government format.

E-invoicing is different. It follows a fixed structure so systems can read and process invoices automatically. It is built for automation, validation, and reporting to tax authorities.

In short, e-invoicing is not just sending a PDF. It is structured data that machines understand.

What Is E-Invoicing in Simple Terms

E-invoicing is the automated exchange of invoices between a seller and a buyer in a digital format, where systems talk to each other directly. It connects the seller’s accounts receivable with the buyer’s accounts payable. In the UAE, this mandate is led by the UAE Ministry of Finance along with the Federal Tax Authority. There will be an accreditation system for Accredited Service Providers, also called ASPs. Once mandatory, the system will replace manual steps like data entry, manual validation, and invoice rechecking.

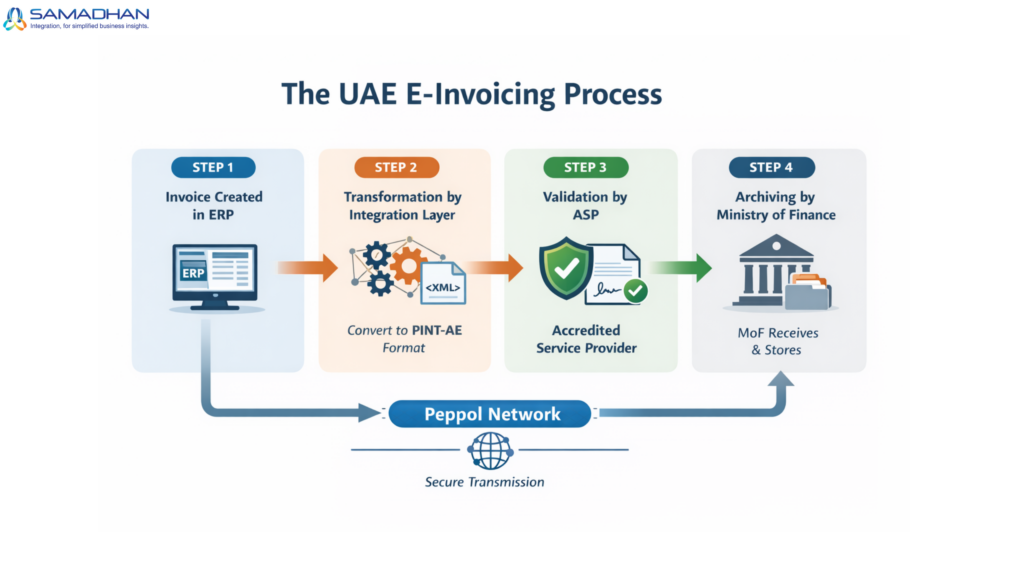

How E-Invoicing in the UAE Actually Works:

The UAE model is structured and digital. It involves three key layers:

- Your ERP system

- An Accredited Service Provider

- An integration layer that connects both

The system is based on PINT-AE, the UAE version of the Peppol international invoice standard. ERP systems such as Microsoft Dynamics 365 can create invoices, but they do not manage full compliance by default.

Here is how the ecosystem works.

Step 1: Invoice Is Created in Your ERP: Your ERP or POS generates a normal invoice after a sale. It includes customer details, items, price, and tax. But this invoice is still raw data. It is not yet in the required PINT-AE format.

Step 2: Integration Layer Converts the Invoice: This is the critical stage. The integration layer, managed by Samadhan as a Microsoft Dynamics 365 partner, acts as the bridge between your ERP and the government system. It performs these actions:

- Extracts invoice data from the ERP

- Maps ERP fields to the PINT-AE XML format

- Applies business rules when needed

- Sends the prepared invoice to the ASP

It also gives your team a dashboard to track invoice status, errors, and resubmissions. ASPs usually do not provide this operational visibility.

Step 3: Accredited Service Provider Validates and Reports: The ASP plays the official role. It will:

- Validate the PINT-AE XML against government rules

- Digitally sign the invoice

- Send it through the Peppol network to the Ministry of Finance and the buyer

The ASP is like an official courier. It does not create or prepare your invoice. It only checks and transmits what it receives.

Step 4: Ministry of Finance Archives the Data: The Ministry of Finance receives and stores the e-invoice data, completing the compliance process.

When Does This Become Mandatory

The mandate is expected to go live from July 2026, in phases. It will apply to VAT-registered businesses involved in B2B and B2G transactions in the UAE. If you issue invoices to other businesses, you will need to comply.

Why Your ERP Alone Is Not Enough

Even if you use Microsoft Dynamics 365, it does not automatically:

- Convert invoices into PINT-AE XML

- Connect directly to an ASP

- Manage validation errors and retries

This is the gap where Samadhan comes in. As a Microsoft Dynamics 365 partner, Samadhan provides the integration layer that connects your ERP to the ASP platform correctly.

Main Challenges Businesses Will Face

Most difficulties will be technical and process related:

- ERP customization

- Data mapping to PINT-AE

- API connection with the ASP

- Managing failed invoice submissions

These are known as last mile integration challenges, and they are where most projects struggle.

Is an ASP Mandatory

Yes. You must use a government accredited ASP.

Their role is to validate, transmit, and report invoices to the Ministry of Finance. Businesses cannot send invoices directly to the government.

Is the System Secure

Yes. The Peppol network is designed for secure document exchange. Data is encrypted and ASPs follow strict security standards.

Why This Change Is Actually Good for Businesses

While it may seem like extra work, e-invoicing brings benefits:

- Faster payments

- Fewer errors

- Lower processing costs

- Better record accuracy

- Reliable delivery

Final Thought

The biggest risk is not the mandate. It is assuming your ERP is already ready.

If your system cannot transform, validate, and transmit invoices in the required format, you will face rejections, delays, and compliance issues. Samadhan, as an official Microsoft Dynamics 365 partner, helps UAE businesses bridge this gap through proper ERP integration and e-invoicing enablement.

Now is the time to prepare, not when the mandate becomes urgent.

+91 6287995736

Alternative way to get answer faster.

info@samadhanindia.com

We are always happy to help.